Are you a director with a personal guarantee? New legislation being introduced on December 1st could have significant impact on you! From December HMRC will become a preferential creditor which means it is much more likely that your personal guarantee will be called upon should your business fail!

What does that all mean?

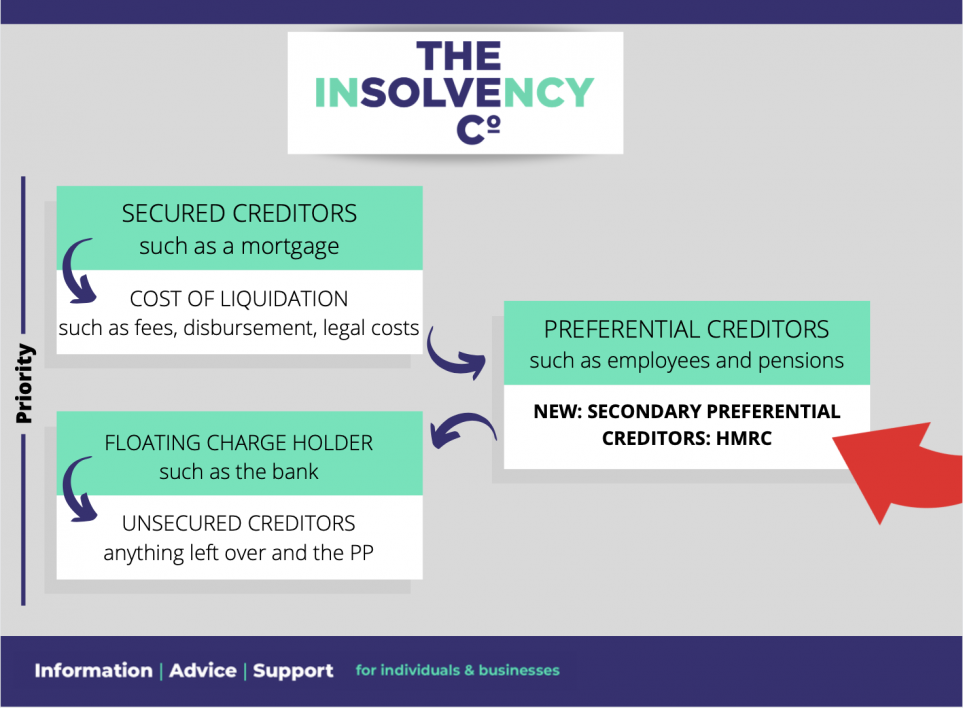

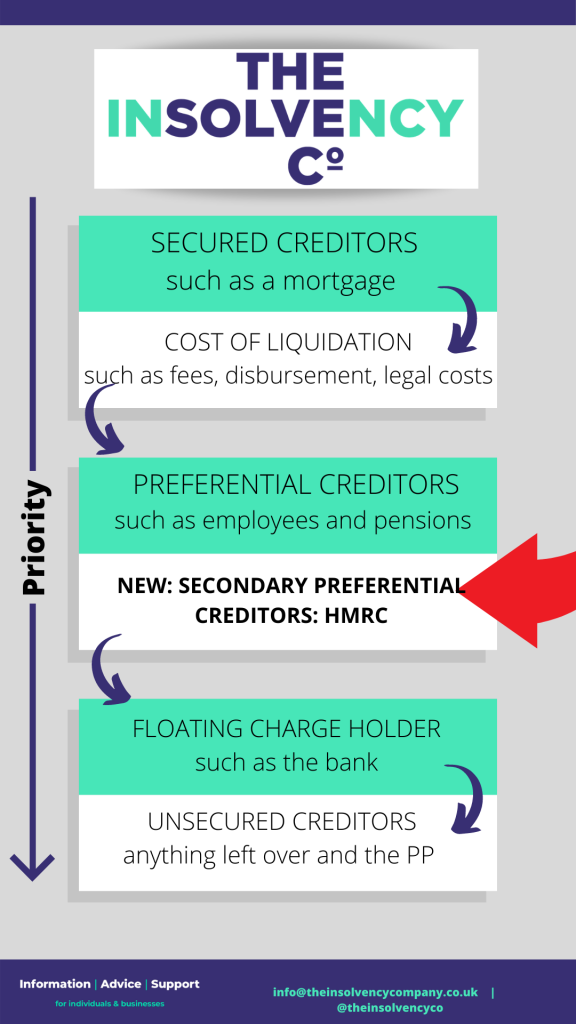

Currently, when a business enters insolvency, the businesses assets are sold, and that money is paid to the company’s creditors in the following order:

- Secured creditors

- Preferential creditors – E.g. employees

- Floating charge holders – E.g. the bank

- and finally, unsecured creditors – E.g. trade suppliers, contractors etc.

The new legislation moves HMRC from unsecured creditors to a newly made category, secondary preferential creditor, below preferential creditors, but importantly above floating charge holders.

This means that an extra layer has been created in the order of priorities in which money is paid when a company enters liquidation. This is likely to have a significant impact on directors who have a personal guarantee. Why?

When the bank lends money, they lend it on the condition that they receive a floating charge over all non-fixed assets (such as stock, money in the company bank account and book debts). A floating charge is merely another form of security for the bank. If a company becomes insolvent the floating assets can be sold to repay the money that was loaned from the bank.

Almost always, this floating charge comes with a personal guarantee from the director which essentially says that if the company does not pay the bank back then the director will have to. However, directors assume that they will not be liable if the company assets can cover the loan (via the floating charge).

With the new rules, HMRC debts (PAYE, VAT etc.) will now be paid before any money is paid to the bank. Usually HMRC is one of the biggest creditors. This means that the bank will get less money from the company and they will seek to enforce their personal guarantee against the director.

It is therefore very important that if any directors have personal guarantees to the bank that they check the financial stability of the businesses, because if it goes into liquidation after 1 December 2020 the chances of the director becoming personally liable has just increased significantly!

If you would like to speak with one of our advisors about how to protect yourself, ring us on 01823 216156 or send us an email.

If you are not yet ready to speak to an advisor, you can find free information and advice on our blog.